Transforming the Management School for the Digital Age

Q-RaP: Queens Management School Remote analytics Platform

Economic progress, in capitalist society, means turmoil- Joseph A. Schumpeter

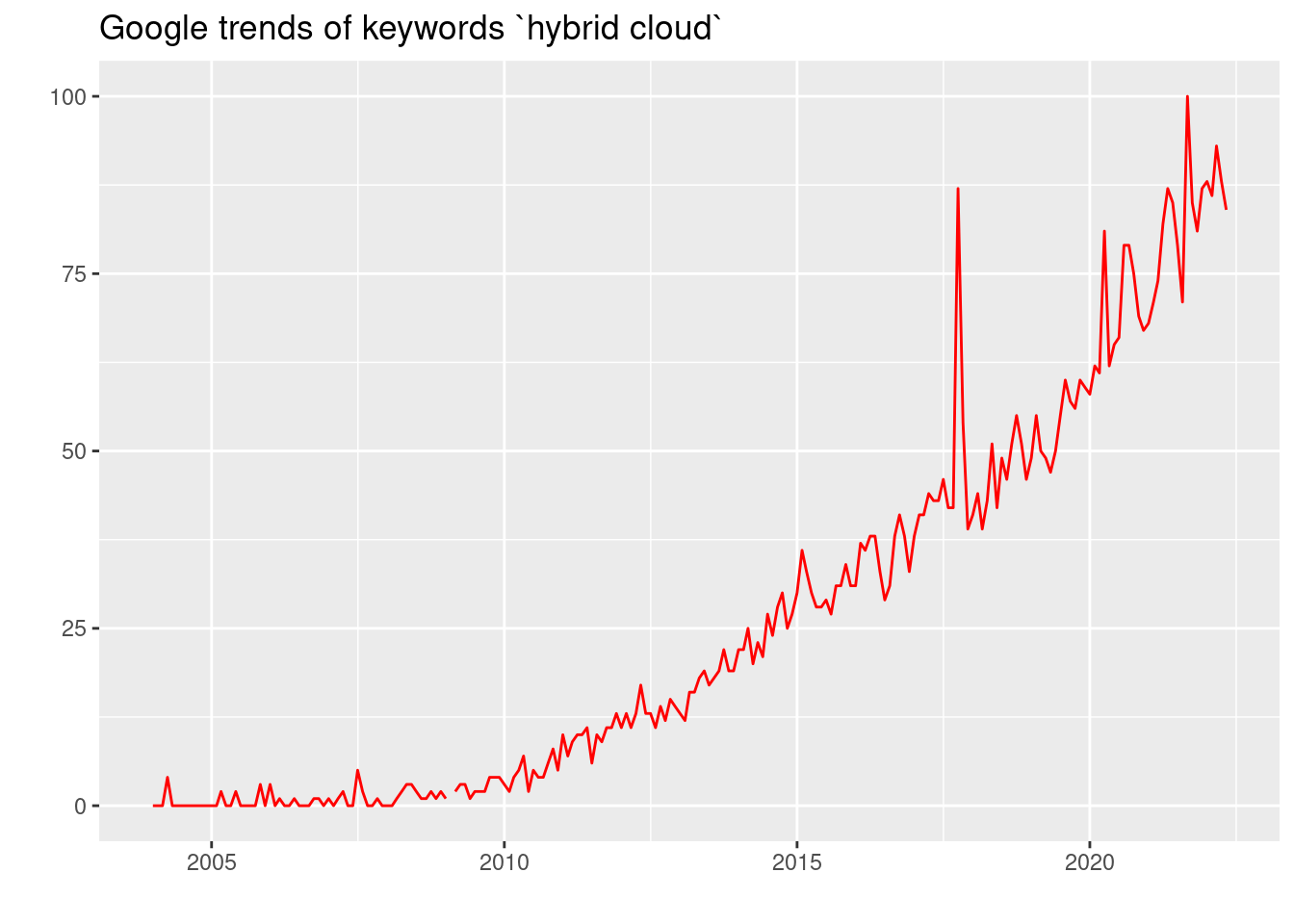

The digital automation of corporate decision making can be traced back as far as 1956, when creditworthiness was coded in a digital algorithm by the Fair Issac Corporation. By 1999, FICO credit scores had largely replaced creditworthiness decisions for loans up to $50,000 in the US1. More recently, viral-like development of algorithms, cloud computation on-demand, and vast data resources are reshaping how digital innovation is disrupting business and spurs economic growth. For instance a growing trend that is still on the move upwards is a hybrid model where companies combine on-premises infrastructure and cloud-based solutions:

In this second machine age, as many more customer facing business go virtual, high-level social skills are becoming more valuable than advanced quantitative ones. The highest payoff for future graduates is likely to be the ability to combine one’s social nature with quantitative skills. The MIT Laboratory for Social Machines research lab is one example where this is working well.

As a Management school, situated in a strategic UK market for RegTech, we most keep pace with this digital arms race to allow our students and staff to remain credible and relevant in how we understand the interaction of social nature and machine. To this extent we have build a high-performance cloud computing platform called Q-RaP.

- Relevant students: Northern Ireland is a hotbed of digital innovation in financial services and plans2 are in place to develop a global hub for regulatory technology3 as part of the wider UK FinTech Strategy outline in the Kalifa Review 20214. Talent and skills are a core component of these plans.

- Credible research: For research, the risks of deploying innovation digital technologies requires independent lab set-ups to achieve credible industry facing output. For example, the main challenges for both RegTech providers and their financial services customers are internal and therefore hard to research on-premises. These challenges point to research gaps in data quality, security and privacy, interoperability and integration with existing legacy systms, lack of Financial Institutions API capabilities quality, security and privacy. The below table from EBA (2021) summarise challenges with internal challenges highlighted.

Table of Challenges and Future Research Directions

| Financial Institutions who adopt RegTech | RegTech Providers | |

|---|---|---|

| 1 | Data‐related challenges and cybersecurity threats | Lack of technological capabilities on FIs’ side |

| 2 | Interoperability and integration with the existing legacy systems | Security, data privacy and protection issues |

| 3 | Changes to regulation | Changes of national and international regulation |

| 4 | Costs and procurement process | Cost of user acquisition |

| 5 | Lack of necessary skills and training | Lack of FIs’ understanding of RegTech solutions |

| 6 | Perceived immaturity of RegTech providers’ solutions | Lack of harmonised legal and regulatory requirements |

| 7 | Clarity of regulatory or supervisory guidance | |

| 8 | Competition with other solutions | |

| Sourced from EBA (2021) |

What is Q-RaP?

Queen’s Management School Remote analytics Platform is a high-performance stack of open science computing technologies which we use to promote rigour, accountability and reproducibility in digital analytics.

This stack is the largest clouding computing infrastructure in the Queen’s University Belfast, built in 2021 and beta-tested on graduate level programmes in the spring semester of 2022.

Running enterprise-level RStudio software, Q-RaP allows the school to teach statistics and advanced analytics, using both R and Python,in a frictionless, interoperable and agile manner. There is no more need for a static computer lab, all students need is a web browser and a growth mindset.

The platform is split into two components based on user sophistication

| Level | Explanation | Set up | Teaching |

|---|---|---|---|

| Foundational | Used to teach 200+ students concurrently on PGT modules | RStudio Cloud Q-RaP using single-sign-in with QUB credentials | Machine learning and advanced analytics (MSc Business Analytics), Derivatives and Time series financial econometrics (MSc Finance, MSc Risk, MSc Quant Finance), Algorithmic trading and investment (MSc Quant Finance) |

| Advanced | Using for PhD training, and advance data visualisation | High-Performance Cloud Computing Suite hosted in Azure and managed by QMS DevOps Team. Access upon request with this form | Statistical inference in the digital age(PhD training) |

Advanced component infrastructure

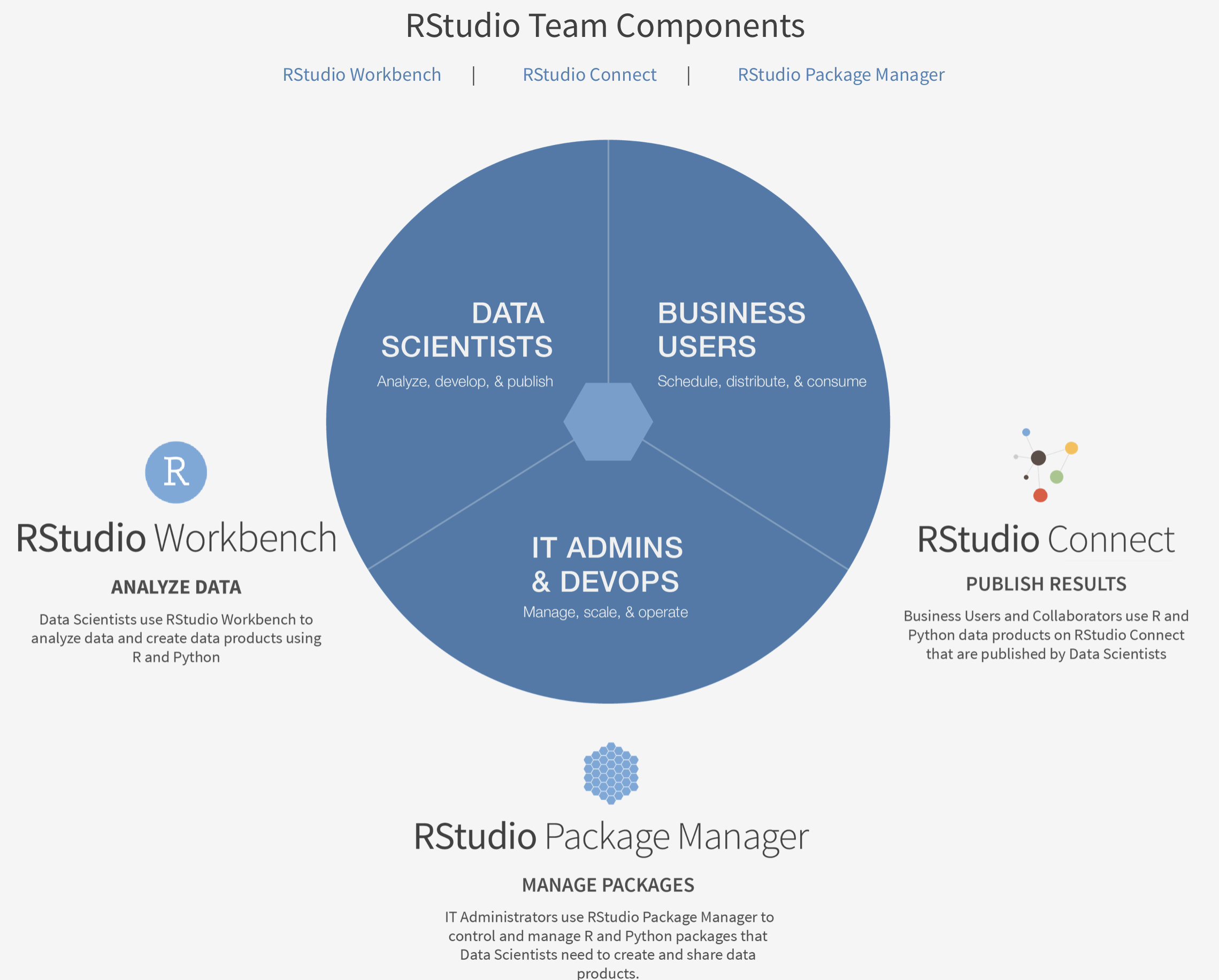

The advance computing infrastructure using the complete suite of RStudio Team products, Workbench for analytics, Connect for professional communication of results, and Package manager for secure storage of python modules and R packages.

The goal of Q-RaP is to embed computation as a central tenet in the ciricula, allowing students to do something interesting with data in the first 10 minutes of the first class.

Q-RaP in action

Some teaching examples

Queen’s Student Managed Fund

Prediction project in econometrics

Student feedback

The feedback from students has been very positive. For example, Samit (MSc Risk and Investment Management) explains how Q-RaP enchanced his learning experience at QMS:

Q-RaP in action in research

This fantastic air pollution dashboard was developed by Dr Neil Rowland as part of his research into Public Health in Northern Ireland.

-

From Byronjolfsson & McAfee (2018) Machine, Platform, Crowd: Harnessing the Digital Future p40 ↩︎

-

FinTech NI submission to the comprehensive spending review in 2021-

https://committees.parliament.uk/writtenevidence/42614/pdf/↩︎ -

Regulatory technology can be defined as a range of applications of technology‐enabled innovation for regulatory, compliance and reporting requirements implemented by a regulated institution (with or without the assistance of RegTech provider) -EBA (2021) Analysis of RegTech In EU Financial Sector ↩︎

-

Kalifa Review of UK FinTech 2021, -

https://www.gov.uk/government/publications/the-kalifa-review-of-uk-fintech↩︎